Apr 5, 2023Not doing so means missing out on tax-deferred growth and matching contributions from employers, Lima said. In 2023, employees can contribute up to $22,500 to a 401 (k) and $6,500 to an IRA. The

2022 State Tax Reform & State Tax Relief | Rebate Checks

Feb 1, 2024For example, say you deposit $5,000 in a savings account that earns a 3% annual interest rate, and compounds monthly. You’d calculate A = $5,000 (1 + .03/12)^ (12 x 1), and your ending balance

Source Image: pinterest.com

Download Image

In the chart below, you’ll find the after-tax take-home pay for a $100,000-a-year salary in the 25 largest US cities, which we calculated using SmartAsset’s paycheck calculator. Shayanne Gal

Source Image: lifeinnorway.net

Download Image

Bonus Time: How Bonuses Are Taxed and Treated by the IRS – Intuit TurboTax Blog From adjusted gross income of $100,000, subtract the standard deduction of $6,350 and a single personal exemption of $4,050. That makes taxable income equal to $89,600. That amount is just below

Source Image: visualcapitalist.com

Download Image

If I Make Over 100k A Year How Much Tax

From adjusted gross income of $100,000, subtract the standard deduction of $6,350 and a single personal exemption of $4,050. That makes taxable income equal to $89,600. That amount is just below Feb 27, 2023You will owe roughly 25% of your income in federal taxes if you make $100k. More specifically, you’d likely pay between 18%-24% of your income. More typically, you might expect to pay between $17,836 and $18,916 in tax. It’s important to note that you will still have to pay this federal tax even if you live in one of the nine states that

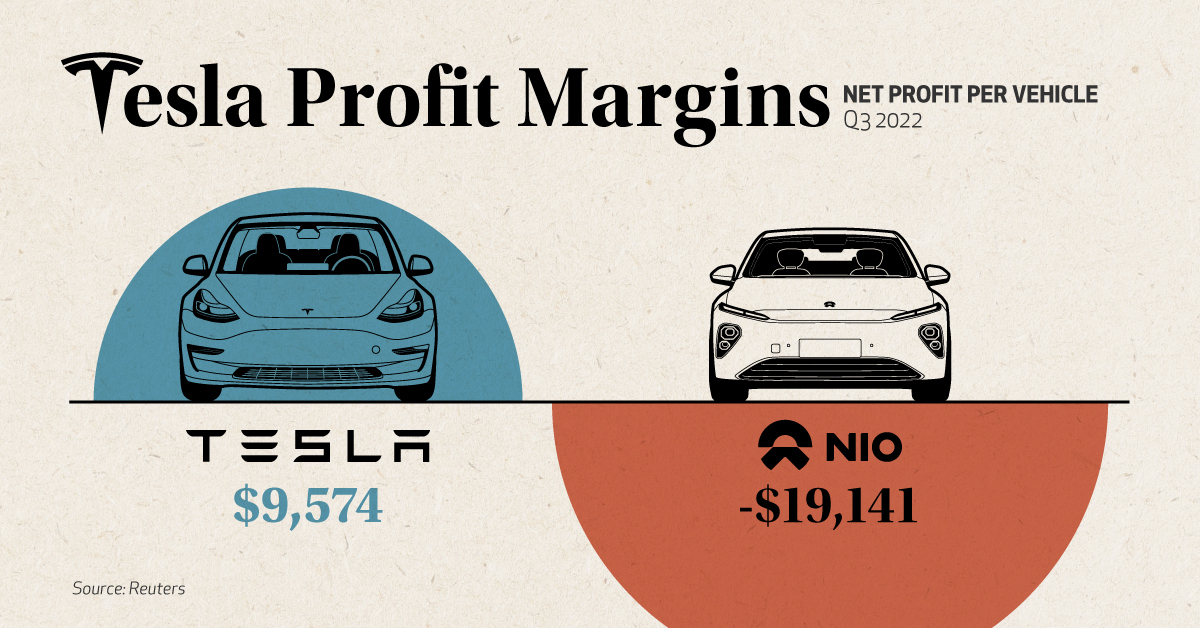

Charted: Tesla’s Unrivaled Profit Margins

Mar 31, 2023The standard deduction on your income taxes. The big thing to know, however, is that you can recognize as much as $89,250 in qualified investment income as a married couple and pay no income. Tack If You Make $100,000 Or More, Here Are 3 Tax Breaks You Don’t Want to Miss | The Motley Fool

Source Image: fool.com

Download Image

A Comprehensive Guide to Pinterest Affiliate Marketing in 2023 Mar 31, 2023The standard deduction on your income taxes. The big thing to know, however, is that you can recognize as much as $89,250 in qualified investment income as a married couple and pay no income. Tack

Source Image: refersion.com

Download Image

2022 State Tax Reform & State Tax Relief | Rebate Checks Apr 5, 2023Not doing so means missing out on tax-deferred growth and matching contributions from employers, Lima said. In 2023, employees can contribute up to $22,500 to a 401 (k) and $6,500 to an IRA. The

Source Image: taxfoundation.org

Download Image

Bonus Time: How Bonuses Are Taxed and Treated by the IRS – Intuit TurboTax Blog In the chart below, you’ll find the after-tax take-home pay for a $100,000-a-year salary in the 25 largest US cities, which we calculated using SmartAsset’s paycheck calculator. Shayanne Gal

Source Image: blog.turbotax.intuit.com

Download Image

Quirk in state’s new $1.87 billion income-tax cut may actually raise taxes for many middle-class Ohioans – cleveland.com What is a $100k after tax? $100000 Federal and State Tax Calculation by the US Salary Calculator which can be used to calculate your 2023 tax return and tax. … (Answer is $ 51.63, assuming you work roughly 40 hours per week) or you may want to know how much $100k a year is per month after taxes (Answer is $ 6,090.79 in this example,

Source Image: cleveland.com

Download Image

Thailand 2024 Tax Tweak – Implications For Digital Nomads, Pensioners & Expats From adjusted gross income of $100,000, subtract the standard deduction of $6,350 and a single personal exemption of $4,050. That makes taxable income equal to $89,600. That amount is just below

Source Image: nomadgirl.co

Download Image

Singapore Personal Income Tax Calculation 2021 Feb 27, 2023You will owe roughly 25% of your income in federal taxes if you make $100k. More specifically, you’d likely pay between 18%-24% of your income. More typically, you might expect to pay between $17,836 and $18,916 in tax. It’s important to note that you will still have to pay this federal tax even if you live in one of the nine states that

Source Image: osome.com

Download Image

A Comprehensive Guide to Pinterest Affiliate Marketing in 2023

Singapore Personal Income Tax Calculation 2021 Feb 1, 2024For example, say you deposit $5,000 in a savings account that earns a 3% annual interest rate, and compounds monthly. You’d calculate A = $5,000 (1 + .03/12)^ (12 x 1), and your ending balance

Bonus Time: How Bonuses Are Taxed and Treated by the IRS – Intuit TurboTax Blog Thailand 2024 Tax Tweak – Implications For Digital Nomads, Pensioners & Expats What is a $100k after tax? $100000 Federal and State Tax Calculation by the US Salary Calculator which can be used to calculate your 2023 tax return and tax. … (Answer is $ 51.63, assuming you work roughly 40 hours per week) or you may want to know how much $100k a year is per month after taxes (Answer is $ 6,090.79 in this example,